PURPOSES

- To support the private sector to invest more in research and development of technology and innovation which will affect the economic development and elevate the national competitive competence

- To support and persuade the private sector to arrange research and development of technology and innovation for government and private agencies

300% TAX EXEMPTION INCENTIVE

A business operator can get 3 times tax exemption incentive from the actual expense on research and development of technology and innovation but not exceeding the maximum limit specified in percentage proportional to the revenue as follows:

- 6% of revenue for the amount exceeding 200 million Baht.

- 9% of revenue for the amount exceeding 20 million Baht but not exceeding 200 million Baht.

- 60% of revenue for the amount exceeding 50 million Baht.

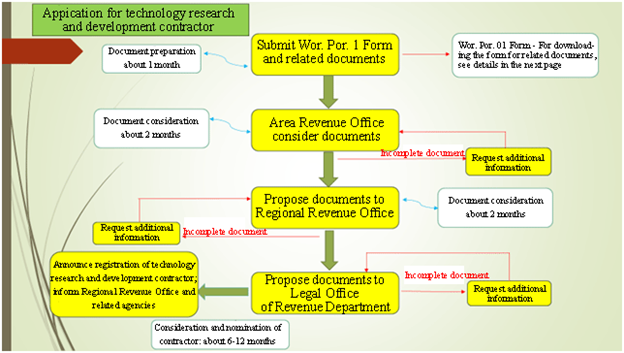

1.1 Process for submitting Wor. Por. 1 Form to the Revenue Department

SUPPORTING DOCUMENTS FOR APPLICATION FORM (WOR.PHOR. 01)

|

List |

Download Document |

|

1. Application Form of WOR.PHOR.01 |

|

|

2. Copy of establishment document showing the main objectives (in case of government agency, excluding ministry, bureau and department). |

|

|

3. Copy of company certificate issued by Registrar of Company Limited and Partnership Registration, memorandum of association and articles of associations (in case of juristic person). |

|

|

4. Copy of household registration and ID card (in case of natural person). |

|

|

5. List of researchers with Bachelor Degree and above in the field related to research and development of technology and innovation or equivalent, including detailed resume and copy of degree (separate full-time and part-time researchers). |

|

|

6. Copy of VAT registration (Phor.Phor. 20), if any. |

|

|

7. Copy of application of VAT registration (Phor.Phor. 01), if any. |

|

|

8. Copy of application for amendment of VAT registration (Phor.Phor. 09), if any. |

|

|

9. Example of receipt with the statement specified in Section 105 bis of Revenue Code including “A research and development grantee no. __________ of Announcement issued by Director General” and “Type of research: __________” |

|

|

10. List of machinery/equipment for research and development of technology and innovation, if any. |

|

|

11. Brief summary of current business operation. |

|

|

12. Plan for research and development of technology and innovation |

Contact Us:

The Revenue Department

RD Call Center 1161

TAX EXEMPTION INCENTIVE: Tel. 02-272-9056, 02-272-9822

1.2 NSTDA-Request for Research and Technology Development and Innovation (Wor Por 300%)

|

Contact for additional information Private Sector R&D Promotion Program Technology Management Center National Science and Technology Development Agency 111, Thailand Science Park, Phahonyothin Road, Khlong Nueng Subdistrct, Telephone: 0-2564-7000 – ext 1328 – 1332; and 1631 – 1634 http:// www.nstda.or.th/rdp |

1. Form and register juristic entity between October 31st 2015 and December 31st 2017, in Thailand, with registered capital of not more than 5 million Baht, and total sales of less than 30 million Baht per year.

2. Receive certificate from NSTDA as a start-up in the 10 following industries.

- Food and agricultural industry

- Energy saving, renewable energy, and clean energy industry

- Biological technology industry

- Medical and public health industry

- Tourism, service business, and creative economy industry

- Advance material industry

- Textile, cloth, and ornament industry

- Automobile and auto part industry

- Electronic, computer, software, and information service industry

3. Revenue from Start-up’s main business accounts for over 80 percents of total revenue.

4. Does not receive tax exemption privilege from BOI.

5. Register and submit the request to become a Start-up at the Revenue Department’s website within December 31st 2017, for General Director’s approval; and wait 15 days for approval’s result, where the affect will take place on the next day after the general director has approved which will also be the first accounting period.

| New Start-up |

|

Tax promotion measure for new entrepreneur Exemption of corporate income tax for 5 accounting periods OPTION 1: OPTION 2: OPTION 3: |

Contact detail for additional information

Revenue Department

RD Call Center: 1161

Enquiry about tax profits: Tel. 02-272-9056, 02-272-9822

Enquiry about operation system: Tel. 02-272-8734, 02-272-8743

Investment Center, Technology Business Development Center, National Science and Technology Development Agency (NSTDA)

111, Thailand Science Park, Phahonyothin Road, Khlong Nueng Subdistrct, Khlong Luang District, Pathum Thani, 12120

Telephone: 02-564-7000; ext 1345, 1327, 1340-1343, 1359

Facsimile: 02-564-7003 Email: nic(at)nstda.or.th Website: www.nstda.or.th/nic

In order to obtain investment promotion, the BOI applicant must follow the conditions prescribed by the Board of Investment as specified in the BOI promotion certificate in which the following incentives will be granted:

Incentives

|

Tax Incentives |

Non-Tax Incentives |

|

|

“Cluster” is concentration of interconnected businesses and related institutions that operate within the same geographic areas. The aim of promoting business clusters is to boost the level of support and cooperation in all facets of the business, both vertical and horizontal, in order to strengthen the industrial value chain, enhancing Thailand’s investment potentials and competitiveness, and expand socioeconomic development to regional and local levels. The government of Thailand has perceived the significance of cluster in the development of the nation’s economy. The cabinet and the Thailand Board of Investment, therefore, proposed the Cluster-based Special Economic Development Zones Policy, or the Cluster Policy in short, which came into effect on 16th September 2015.